Read Full Article at RT.com]]>

The Bank of Russia has raised its key interest rate from 16% to 18%, citing inflationary pressures. Domestic demand continues to exceed the economy’s capacity to produce goods and services to meet it, the regulator said in a statement on Friday.

Inflation has accelerated and is running substantially above the bank’s April forecast, the statement added. The Bank of Russia has “substantially revised” its projection, predicting an overall rate of 6.5-7.0% in the current year. Inflation in June stood at 8.6%, more than a double the government target of 4%.

]]> Read more

The key rate will remain high “for as long as necessary” to bring inflation down to the government target of 4%, Nabiullina stated. A further tightening of monetary policy may be necessary, she added.

The central bank said the latest rate hike will help bring inflation down to 4.0-4.5% in 2025.

The Bank of Russia previously raised the key interest rate in December. A 100 basis points increase to 16% per annum was the fifth hike in a row since the summer of 2023, when the basis was at 7.5%.

]]> READ MORE: Putin outlines new digital currency policy ]]> The central bank also cited economic indicators from the second quarter of this year as showing that the Russian economy continues rapid growth. Consumer activity remains high against the backdrop of significant growth in household incomes and consumer confidence, the regulator said.Russia’s GDP grew 3.6% in 2023 compared to the previous year. In April, the International Monetary Fund projected 3.2% growth for the country’s economy for 2024.

The Bank of Russia will hold its next key rate review meeting in September.

]]>Read Full Article at RT.com]]>

Dutch Parliament members have addressed the minister of foreign affairs to express concern over the EU’s increasing dependence on Russian gas.

In a letter submitted earlier this week, the MPs suggested that Russian pipeline natural gas is cheaper than liquefied natural gas, which is shipped to the EU by the US and others, adding that this hinders progress towards stable investments into more sustainable options and infrastructure for alternatives to Russian gas.

Prior to the escalation of the Ukraine conflict, Russia’s annual supplies to the EU amounted to around 155 billion cubic meters (bcm), primarily via pipelines.

Gazprom, once the EU’s main gas provider, dramatically reduced its exports to the bloc in 2022, following the sabotage of the Nord Stream pipelines. The Nord Stream 1 pipeline, which runs under the Baltic Sea and carried natural gas from Russia to the EU, along with the newly built Nord Stream 2, were ruptured by underwater explosions in September 2022, rendering them inoperable.

Ukraine-related sanctions introduced by Brussels against Russia haven’t targeted pipeline gas supplies so far, but many members, including Poland, Bulgaria, Finland, the Netherlands, and Denmark, have halted their imports voluntarily. However, several EU nations, including Austria, Slovakia, the Czech Republic, and Italy, are still importing Russian pipeline gas.

]]> Read more

The remaining transit of Russian gas via Ukraine and Turkey currently amounts to around 15 bmc per year.

The five-year agreement between Gazprom and a Ukrainian operator expires at the end of 2024. The EU is planning to completely phase out energy imports from the country by 2027.

Last week, Reuters reported, citing data by the Gas Exporting Countries Forum, that Russian pipeline gas exports to the EU countries soared 24% in the first half of the year versus the same period in 2023. Earlier this month, the agency stated that supplies in June jumped by almost 23% from a year earlier.

]]>Read Full Article at RT.com]]>

US-based credit rating agency Fitch has warned of an imminent default in Ukraine, announcing in a statement on Wednesday that it had further downgraded Kiev’s credit rating.

The agency said the move from ‘CC’ to ‘C’ reflects its view that a default or default-like process for Ukraine has begun, after Kiev reached an agreement in principle with a group of foreign investors to restructure its $20 billion debt.

The Ukrainian government on Monday struck a preliminary deal with the bondholders’ committee on restructuring terms. The proposal provided a 37% nominal haircut on Ukraine’s outstanding international bonds, saving Kiev $11.4 billion in payments over the next three years. Ukraine will issue new Eurobonds in return.

The move comes after the Ukrainian parliament approved legislation last week allowing the government to suspend debt payments for three months and enter a debt default, while the restructuring agreement with investors is finalized.

]]> Read more

According to the company, the move “marks the start of a default-like process.”

The agency also predicted the state deficit to remain high at 17.1% of Ukraine’s GDP this year, noting defense spending amounted to 31.3% of GDP in 2023.

The agency projects government debt to surge to 92.5% of the country’s GDP in 2024.

]]>Read Full Article at RT.com]]>

Individuals and legal entities from the EU are prohibited from participating in a frozen “asset swap” scheme proposed by Russia, according to the European Commission. The department responsible for EU policy on financial services posted the clarification on Wednesday.

In March, Russia launched an asset-swap scheme that aimed to allow both Russian and foreign investors to free up funds blocked due to the West’s Ukraine-related sanctions and Moscow’s countermeasures. The swap deal gave investors an opportunity to exchange Western securities that are frozen in EU depositories for Western funds immobilized in Russia, though the amount of each transaction could not exceed 100,000 rubles ($1,180).

The scheme was first introduced under a decree by Russian President Vladimir Putin’s in November last year, and Russia’s Finance Ministry later appointed Investitsionnaya Palata, a broker not targeted by Western sanctions, to organize the exchange.

However, the asset swaps would involve the National Settlement Depository (NSD) of the Moscow Stock Exchange (MOEX), which facilitates transactions with securities. According to the European Commission, the NSD’s participation makes it impossible for EU residents to take part in the swaps, due to the depositary’s listing on the EU sanctions blacklist.

]]> Read more

The Russian broker’s representative had earlier explained that the exchange mechanism would be designed in such a way as to minimize the role of the NSD, with the depository prohibited from charging fees for settlements as part of the swap deals. The NSD would essentially play a technical role in the proposed transactions, maintaining their records.

Commenting on the statements made by EU regulators, Gleb Boyko, a lawyer at the NSP law firm, told Forbes Russia that they could not be considered a normative legal act, which means some investors may still risk taking part in the swap deals. Artem Kasumyan, a lawyer at the Delcredere Bar Association, added that sanctions against the NSD are not absolute, and allow EU investors to ask permission for transactions from competent authorities on a case-by-case basis.

]]> READ MORE: EU moves to freeze Russian assets indefinitely – FT ]]> According to Investitsionnaya Palata, the asset-swap transactions are set to take place on August 12. The broker noted that it had been forced to postpone the deadline due to the number of requests from foreign participants.Russian retail investors offered to buy out assets totaling 35 billion rubles, the broker had earlier reported. In total, around 2,500 types of assets were submitted for exchange, most of them shares and depositary receipts for shares of foreign issuers such as Alphabet, Tesla and Microsoft.

For more stories on economy & finance visit RT's business section

]]>Read Full Article at RT.com]]>

EU imports of Russian fertilizer soared by 70% to 1.9 million tons between January and May this year compared to the same period in 2023, Vedomosti reported on Tuesday, citing Eurostat data.

In monetary terms, the bloc’s purchases amounted to more than €649 million ($703 million), marking a year-on-year increase of 30%.

In May alone, imports rose by 5% year-on-year to €77.4 million ($83.8 million) in monetary terms and by 17% to 238,400 tons in volume. The growth is mainly attributed to an increase in purchases of potassic manure and multiple-nutrient fertilizers, the outlet noted.

Meanwhile, EU imports of Russian nitrogen fertilizers grew by 39% in the first five months of this year, and amounted to 57% of the bloc’s entire purchases of fertilizers from the country. Poland emerged as a top buyer of Russian urea having increased imports by 25% to almost 468,000 tons. It was followed by France, Germany and Italy, which boosted purchases by 12%, 11% and 10%, respectively.

Vedomosti noted that fertilizer production costs had soared across the bloc in 2022 as a result of rising natural gas prices. Back then, Russian energy giant Gazprom – once the EU’s main gas supplier – dramatically reduced exports to the bloc following Western sanctions and the sabotage of the Nord Stream pipelines.

]]> Read more

Last year, the Federal Statistical Office (Destatis) revealed that Germany had boosted purchases of Russian fertilizers by roughly 334%, from 38,500 tons in July 2022 to 167,000 tons in June 2023. Meanwhile, imports of urea alone soared by 304% in the first half of 2023 compared to the same period of the previous year.

Earlier this year, CEO of Norwegian chemical producer Yara International, Svein Tore Holsether, warned in an interview with FT that bloc was becoming more and more dependent on Russian fertilizers, just as it did with natural gas.

]]>Read Full Article at RT.com]]>

Russian gas exports to China could reach 30 billion cubic meters this year via the Power of Siberia mega-pipeline, Deputy Prime Minister Aleksandr Novak has said.

The pipeline’s operator, Gazprom, supplies natural gas to Russia’s Asian neighbor under a long-term contract it sealed with the China National Petroleum Corporation (CNPC). The Power of Siberia is part of a $400 billion, 30-year agreement between Gazprom and CNPC which was clinched in 2014.

“Pipeline gas supplies are growing … Next year we will reach 38 billion cubic meters. This is a contractual obligation, the maximum volume that we will reach under the contract,” Novak told reporters on Tuesday.

Gazprom has exceeded its contractual obligations on a regular basis throughout the past year, with daily records reported frequently. The Russian company increased gas supplies to China via the Power of Siberia by 50% year-on-year in 2023, to 22.7 bcm exceeding Gazprom’s contractual obligations by 700 million cubic meters.

The company is projecting that gas supplies to Russia’s leading trading partner will grow further thanks to soaring demand.

Moscow and Beijing could soon sign a contract for the construction of the mega-pipeline Power of Siberia 2, which is expected to allow for up to 50 bcm of gas to be delivered annually from Yamal Region in northern Russia to China via Mongolia.

]]> Read more

According to Novak, discussions on the implementation of the Far Eastern route for gas supplies to China are also underway.

The Far Eastern route will deliver supplies of Russian natural gas from the shelf off Sakhalin Island to China starting from 2027. Moscow and Beijing sealed an agreement for additional pipeline gas deliveries via the new route in February 2023.

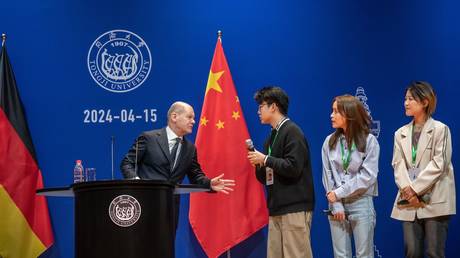

China has increased imports of Russian gas and oil by 22.5% and 4.8%, respectively, in the first half of this year on annual basis, according to the country’s Vice Premier Ding Xuexiang.

]]>Read Full Article at RT.com]]>

Ukraine has reached an agreement in principle with a group of foreign investors to restructure its $20 billion debt, as Kiev tries to retain access to international markets, the government has announced.

Bondholders – including US financial giants BlackRock and Pimco, as well as French asset manager Amundi – granted Ukraine a two-year debt freeze in February 2022 when the conflict with Russia broke out.

The bondholders’ committee, which controls 25% of the bonds, has agreed to accept losses of 37%, or $8.7 billion, on the nominal value of their debt, according to a statement with the terms of the accord published on the London Stock Exchange.

The International Monetary Fund (IMF) reportedly confirmed that the deal was compatible with the parameters of a $122 billion aid package to Kiev. Both the IMF and the country’s creditors, which include the US and the Paris Club, have signed off on it, according to the statement.

Kiev expects the discount to help it save tens of billions in payments in the coming years.

“This is an important stage in the debt restructuring process, which will save $11.4 billion in debt servicing over the next three years and $22.75 billion until 2033,” Prime Minister Denis Shmigal wrote on Telegram on Monday, adding that the deal would free up resources for defense.

]]> Read more

Ukraine’s announcement comes just over a week before the expiration of the debt-suspension agreement and marks the first time a country has embarked on a debt restructuring in the midst of a conflict. Last week, Kiev passed a law allowing it to miss payments and enter a debt default, while the restructuring agreement with investors is finalized.

Under the proposal, the creditors agreed to rework the existing claims into two series of bonds. The first standard bond series would start paying a 1.75% coupon from 2025, and will reach as much as 7.75%, with capital payments starting in 2029.

A second series making up 23% of the outstanding claim will offer higher payments if Ukraine’s economy outperforms IMF expectations in 2028, according to the terms of the preliminary deal.

Bondholders will vote on the proposal in the coming weeks.

]]>Read Full Article at RT.com]]>

The number of bankruptcy declarations in England and Wales reached the highest level in over a year last month, as soaring interest rates weighed on companies’ budgets, according to a report by the UK’s Insolvency Service on Friday.

According to the data, 2,361 companies went out of business last month, a 17% surge compared to the same month last year. It was the highest number since May 2023, and the joint third-highest on record going back to 2000, the report said.

Construction was the worst-affected industry following a dip in the housing market, with 1,700 companies having entered bankruptcy between January and May 2024, data showed.

The trade industry, including the retail and wholesale sectors, as well as accommodation and food services, restaurants and bars, have been affected by a decline in consumer demand and saw around 3,000 companies file for bankruptcy in the reported period.

]]> Read more

Interest rates at levels not seen in the UK for over a decade are pushing the cost of borrowing up, alongside high inflation, weak consumer confidence, and rising operating costs, having a heavy toll on company balance sheets, experts say.

“A drop in interest rates is now perhaps unlikely to take place until later this year, although there is still hope of a reduction in August,” Supperstone noted.

Business insolvencies in the UK have been on the rise since the removal of support measures that the British government put in place during Covid-19, and are now well above levels registered before the pandemic, the report said.

]]>Read Full Article at RT.com]]>

Brussels-based depositary and clearing house Euroclear has confirmed that it will confiscate interest generated by the frozen Russian funds that it holds and will transfer the money to Ukraine.

“In July 2024, Euroclear will make a first payment of €1.55 billion to the European Fund for Ukraine following the recent implementation of the EU regulation on the windfall contribution,” Euroclear said in a statement on Friday.

It follows months of deliberations among EU and G7 nations about how to use billions of dollars belonging to Russia’s central bank that were immobilized as part of Ukraine-related sanctions.

The announcement came as part of a report on the financial results for the first half of 2024, which revealed that frozen Russian assets had generated €3.4 billion ($3.7 billion) of the €4 billion ($4.36 billion) interest accrued by the clearing house during the six-month period.

]]> Read more

The EU immobilized around €210 billion ($229 billion) of sovereign assets belonging to Russia’s central bank as part of sanctions imposed on Moscow over the conflict in Ukraine. The bulk of the funds is held in the privately owned depository. The clearing house previously reported that the assets had generated roughly €4.4 billion ($4.8 billion) in interest last year.

In June, the EU Foreign Affairs Council announced that it would make windfall profits from immobilized Russian funds available to Ukraine. The first tranche will be used to purchase ammunition and air-defense systems, it said, adding that another €1 billion will be transferred by the end of the year.

Some G7 members, such as the US and the UK, had been pushing for the outright seizure of Russian assets. Concerns over the legality of such a move led to a decision to use the interest generated by the funds instead.

Russia has repeatedly said any actions taken against its assets would amount to “theft,” insisting that seizing the funds or similar moves would violate international law and lead to retaliation.

Kremlin spokesman Dmitry Peskov warned this week that “illegal attempts to rob the Russian Federation” would cause huge damage to the international financial system.

]]>

Read Full Article at RT.com]]>

A Texas-based investment company has denied trying to short twelve million shares of Trump Media & Technology Group just before the failed assassination attempt on the US presidential candidate, claiming it was a clerical error.

Short selling involves borrowing a security whose price the borrower thinks is going to fall and then selling it on the open market. One then buys the same stock back later, hopefully for a lower price than it was initially sold for, returns the borrowed stock to the broker, and pockets the difference.

Trump was speaking at a rally in Butler, Pennsylvania on Saturday when an assassin fired several shots at his head, nicking his ear, killing one audience member and injuring two more.

The day before, a company called Austin Private Wealth LLC made a filing with the US Securities and Exchange Commission (SEC) for a put option on 12 million shares of $DJT. To outside observers, this looked like a bet that the company’s value would go down drastically – as it would if Trump had been killed.

One sleuth on X (formerly Twitter) even got screenshots from a Bloomberg terminal showing the company’s put option, which then disappeared later in the day.

Others pointed out that Austin had major holdings in Vanguard and BlackRock funds, claiming that they had links with George Soros and the Rothschild family as well.

The apparent BlackRock connection fueled suspicions further, as the alleged shooter had once appeared in a commercial for the investment behemoth. BlackRock yanked the ad after the attempted assassination, which they denounced as “abhorrent” and “awful.”

]]> Read more

“The SEC filing which showed that Austin Private Wealth shorted a large number of shares of Trump Media & Technology Group Corp (DJT) was incorrect and we immediately amended it as soon as we learned of the error,” the company said.

APW holds 12 contracts, or 1,200 shares, not twelve million “as was filed in error,” the statement said, blaming a “third party vendor” for multiplying all options contracts by 10,000. The report was filed on July 12 to reflect the company’s June 28 position, but was amended on July 16, when APW became aware of the problem.

“We deeply regret this error and the concern it has caused, especially at such a fraught moment for our nation,” the company said, adding that it is “reviewing our internal procedures” to understand how it happened.

Anyone who shorted the DJT stock came to regret it. On the first day of trading after the Butler shooting, its price jumped from $31.25 to $46.17 a share, before stabilizing at just above $37.

]]>Read Full Article at RT.com]]>

A British company has announced that it will begin selling artificial chicken to pet-food producers this year, making Britain the first country in Europe to commercialize ‘lab-grown’ meat.

Owen Ensor, the CEO and co-founder of the start-up firm Meatly, said on Wednesday that the business has received approval for its products from the Animal and Plant Health Agency (APHA) and the Department for Environment, Food and Rural Affairs.

Meatly was able to capitalize on a window of opportunity created by Brexit, which freed the UK from EU regulations. It also benefited from the recent government focus on biotech and innovation, which saw its cultivated meat get the greenlight, Ensor told the Financial Times.

According to the entrepreneur, the “very exciting” thing about the approval is that “it shows the intention of the UK to be positioned as a leader in these new innovative fields and in food technology.”

]]> Read more

Ensor believes pet food will become the natural starting point for the cultivated meat market in Britain.

A Meatly spokesperson told Just Food website that, despite the company currently being “primarily focused on pet food,” its processes and products are safe and healthy for humans. “We will likely license our industry-leading technology to human food companies,” they said.

Meatly, which has so far raised £3.5 million ($4.6 million) from investors including US venture capital firm Agronomics and UK pet-food retailer Pets at Home, said it expects to reach industrial volumes within the next three years.

According to the spokesperson, the company will now try to establish itself in the US, Canadian, and EU markets “for pet food initially.”

The cultivated or cultured meat, which is made from animal cells grown in vats, is currently approved for human consumption in the US, Singapore, and Israel.

]]> READ MORE: 3D printed fish set to hit the market ]]> The EU has not yet made a decision on ‘lab-grown’ meat, but Italy, France and Austria have already said they will ban such products, even if they are allowed by the bloc.Opponents of cultivated meat argue that its long-term health effects have not yet been studied, that it puts livestock in danger, and that it requires so much energy to produce that it would end up doing more ecological damage than animal farming.

]]>Read Full Article at RT.com]]>

The newly launched digital ruble should be fully incorporated into the Russian economy now that the test phase of its adoption is drawing to a close, President Vladimir Putin announced on Wednesday.

Speaking at a government meeting on economic issues, Putin said the pilot launch of the electronic currency had proved a success, and that the project is ready for wider implementation.

“The pilot launch of the digital ruble platform has shown its efficiency and functionality. And now we need to take the next step, namely to move toward a wider, full-scale implementation of the digital ruble in the economy, in business activities and in the field of finance,” the president suggested. He added that he plans to discuss the steps intended to speed up this process with regulators.

The idea of introducing a national digital currency was unveiled by the Bank of Russia in late 2020, and the digital ruble officially became operational on August 1 last year. Unlike virtual currencies such as Bitcoin, the digital ruble is an electronic form of the Russian national currency issued by the Central Bank and backed by traditional money. Regulators say that the digital ruble is intended to ease making money transfers and payments both inside and outside Russia, as it will not depend on bank restrictions such as commissions and limits.

]]> Read more

According to the president, 12 banks, 600 individuals and 22 trade and service enterprises from 11 cities across Russia have already taken part in the trial phase of the currency’s adoption. As of July 1, they conducted more than 27,000 transfers and over 7,000 payments for goods and services using the digital ruble.

According to the Bank of Russia, 21 more lenders are currently preparing to join the project, which could happen as soon as September this year. The regulator has also started testing settlements using the digital ruble with a number of Russia’s foreign partners, its first deputy chairman Olga Skorobogatova told TASS earlier this month.

Central bank governor Elvira Nabiullina suggested in April that the full adoption of the digital ruble for mass use might take 5-7 years.

]]> READ MORE: Shanghai Cooperation Organization speeding up de-dollarization – Putin ]]> “This will be a natural process because the choice of the people and businesses is fundamental: it should be convenient for them,” she told RIA Novosti news agency.For more stories on economy & finance visit RT's business section

]]>Read Full Article at RT.com]]>

Moscow and Budapest are trying to resume supplies of Russian oil to Hungary after transit was blocked via the territory of Ukraine, the TASS news agency has reported, citing Hungarian Foreign Minister Peter Szijjarto.

In June, Kiev toughened sanctions on Russian oil major Lukoil by banning it from using Ukraine as a transit country for energy supplies. Lukoil clinched a five-year deal for exporting around four million tons of oil a year with Hungarian energy firm Mol back in 2019.

The companies are working on an effective solution to the transit issue, Szijjarto reportedly told journalists on the sidelines of a UN conference in New York shortly after a meeting with his Russian counterpart Sergey Lavrov.

“We discussed the issue of safe supplies of gas and oil to Hungary from Russia,” the minister said. “If we talk about oil supplies, a new legal situation has now arisen in Ukraine, forcing Lukoil to halt the supplies to Hungary.”

]]> Read more

Szijjarto added that Moscow and Budapest were working on a legal solution that would allow the two nations to resume oil deliveries, emphasizing that Russian crude was important for Hungary’s energy security.

“We have also discussed the issue of gas supplies, which suits Hungary very well. Gas supplied via the Turkish Stream pipeline provides us with reliable energy supply,” the top diplomat said.

The EU banned its member states from importing Russian crude on December 5, 2022, as part of the sixth package of Ukraine-related sanctions on Moscow. However, pipeline supplies were exempted. Hungary, along with Slovakia and the Czech Republic, continued to import oil from Russia. In June 2023, Brussels approved the 11th package of sanctions, banning the transportation of oil from Russia along the northern branch of the Druzhba pipeline to Germany and Poland. Oil supplies along the southern branch of Druzhba towards Hungary were not subject to sanctions.

]]>Read Full Article at RT.com]]>

China led the way in global alcohol sales in 2022, a new study by the World Spirits Alliance (WSA) has found. Overall, the spirits industry contributed $730 billion to global GDP and supported 36 million jobs worldwide, the WSA said.

In its ‘Spirits: Global Economic Impact Study 2024’ report, the WSA said the spirits sector plays a key role in “driving economic growth, generating significant tax revenues and creating millions of jobs around the world.”

China topped the rating with a market worth $215 billion, according to the report, which ranks countries by alcohol sales volumes. The US was next on the list with more than $60 billion. India and Russia shared third place in terms of spirits sales volumes with around $20 billion each, the Geneva-based WSA said.

]]> READ MORE: Moscow temporarily nationalizes packaging giant’s assets ]]> The industry generated $390 billion in tax revenue in 2022, the equivalent of a top 20 global economy. Manufacturers in the sector spent some $120 billion with their suppliers, more than half of which went directly to supporting agriculture.“Notably, more than half of the spirits sold globally are now at the premium level or above, proof that our consumers are embracing the ‘drink less, but better’ philosophy,” Philippe Schaus, CEO of Moёt Hennessy and president of the WSA noted.

Helen Medina, CEO of the WSA, stressed the significant economic impact the spirits sector has worldwide, adding that the report provides an “important reminder of what a success story the global spirits sector is” at a time of rising trade tensions.

]]>Read Full Article at RT.com]]>

Tokyo will shoulder 520 billion yen ($3.3 billion) in loans to Kiev funded by proceeds from Russian assets blocked as part of Western sanctions, the Kyodo news agency reported on Wednesday citing diplomatic sources.

The figure represents some 6% of the massive loan agreed by the Group of Seven natons during their summit in Italy in June. G7 leaders reached an agreement on using interest from frozen Russian funds to finance a $50 billion loan to help Kiev buy weapons and rebuild damaged infrastructure.

Kyodo cited diplomats as saying that Japanese authorities would hurry to finalize the necessary steps to implement their share of the financial support by the end of the current year.

G7 finance ministers and central bank chiefs are reportedly poised to approve the loan package, in which the US and the EU each lend $20 billion and Japan, the UK and Canada lend a combined $10 billon, at a G7 meeting in Rio de Janeiro later this month.

The West froze nearly $300 billion in assets belonging to the Central Bank of Russia shortly after the escalation of the Ukraine conflict in 2022. Most of the blocked funds are held in the EU, primarily in the Belgium-based depositary and clearing house Euroclear.

]]> Read more

Earlier this month, Ukrainian Defense Minister Rustem Umerov said that Kiev would use the money to strengthen its defense capabilities and support manufacturers, adding that the bulk of the money would go towards purchasing ammunition and air defense systems.

Moscow has denounced the Western measures, emphasizing that military assistance to Kiev only prolongs the conflict. Russia has also condemned the freezing of its assets and warned against tapping them, which it sees as outright “theft.”

Earlier this year, Kremlin spokesman Dmitry Peskov said that expropriation of Russian sovereign funds could create a dangerous precedent and become a “solid nail in the coffin” of the Western economic system. He stressed that Moscow would inevitably retaliate to such a move by launching legal proceedings against entities that tap its assets.

]]>Read Full Article at RT.com]]>

SpaceX CEO and X owner Elon Musk has said that he will relocate the headquarters of both companies from California to Texas in response to a new law forbidding teachers in the Golden State from telling parents if their children identify as transgender.

California Governor Gavin Newsom signed the SAFETY Act into law on Tuesday. Hailed by activists as a safeguard against the “forced outing” of gay or transgender kids, the law forbids school staff from informing parents if their children identify as gay in the classroom, or use names or pronouns that differ from those on their birth certificates.

Critics slammed the bill as an infringement on parental rights.

“This is the final straw,” Musk wrote on X. “Because of this law and the many others that preceded it, attacking both families and companies, SpaceX will now move its HQ from Hawthorne, California, to Starbase, Texas.”

This is the final straw.

— Elon Musk (@elonmusk) July 16, 2024

Because of this law and the many others that preceded it, attacking both families and companies, SpaceX will now move its HQ from Hawthorne, California, to Starbase, Texas. https://t.co/cpWUDgBWFe

Musk explained that he made it “clear to Governor Newsom about a year ago that laws of this nature would force families and companies to leave California to protect their children.”

In a follow-up post, Musk said that he would relocate X’ HQ from San Francisco to Austin, Texas. “Have had enough of dodging gangs of violent drug addicts just to get in and out of the building,” he said, referring to San Francisco’s well-documented homelessness, drug abuse, and street-crime problems.

]]> Read more

Musk already moved Tesla’s HQ from the tech hub of Palo Alto in California to Austin in 2021, and moved his personal residence from California to Texas in 2020. Aside from distancing himself from coastal liberalism – which he has described as “the woke mind-virus,” the move allowed Musk to avoid tax on his personal income.

In 2023, Musk told his biographer, Walter Isaacson, that he blamed his transgender daughter’s liberal Los Angeles school for encouraging her to become “a full communist” and to sever all ties with her father the year before.

“She went beyond socialism to being a full communist and thinking that anyone rich is evil,” Musk said of his now 20-year-old child. “I’ve made many overtures, but she doesn’t want to spend time with me.”

Musk has also spoken out repeatedly against child sex changes, stating last year that he “will be actively lobbying to criminalize making severe, irreversible changes to children below the age of consent.”

]]>Read Full Article at RT.com]]>

Russian nuclear energy giant Rosatom is “ahead” in bidding to construct a second nuclear power plant in Türkiye, Bloomberg reported on Tuesday, citing Energy Minister Alparslan Bayraktar.

While Rosatom already began work at Türkiye’s first Akkuyu nuclear power plant in April, Ankara, which aims to install 20 gigawatts of capacity by 2050, is in talks with Russia, China, South Korea, and the US on the construction of two more nuclear facilities.

The $20-billion Akkuyu project, the first nuclear plant in Türkiye, is expected to provide more than 10% of the country’s electricity needs. It should enable Ankara to reduce the cost of power generation and result in lower prices for consumers, according to Bayraktar.

He noted that Russia’s experience with the Akkuyu plant makes it well-placed to build the new Sinop plant, a four-reactor facility on the Black Sea coast.

“This is the main reason why they’re naturally keen and in this sense I and many others think they’re ahead,” he told the outlet. Rosatom is “a company that’s invested in Türkiye and has gained experience,” he added.

]]> Read more

In addition to Sinop, Türkiye is in talks with China and the US on plans for a third nuclear power plant in the north-western Thrace region. According to Bayraktar, US nuclear technology company Westinghouse Electric is interested in building conventional and small modular nuclear projects in the country, with executives from the company scheduled to visit Türkiye later this month.

Meanwhile, Russia may also bid for the plant in Thrace, according to the head of Rosatom, Aleksey Likhachev.

“It may well be so that several vendors will compete for it. We are not afraid of competition; on the contrary, it is more to inspire us,” he said earlier this year.

Moscow and Ankara have forged close ties in recent years, with Russia becoming Türkiye’s main oil and gas supplier. According to Bloomberg, broader participation in nuclear energy projects will give Moscow access to the country’s electricity market supplying some 85 million people.

]]>Read Full Article at RT.com]]>

Russia is planning to simplify satellite access to high-speed internet for users on the country's extensive public transport network, the Izvestia newspaper reported on Tuesday, citing official documents.

Access will reportedly be provided by operators of new satellite systems in non-geostationary orbit, allowing private users or a transport company to purchase a transmitter-receiver that will connect them to the internet after installing it in a car, a plane, or a train carriage.

In May, Russian Railways signed a cooperation agreement on the application of satellite technologies with the Russian space company BURO 1440. Under the deal, the parties will develop digital services based on low-orbit satellites and create popular IT solutions for industry.

“Services based on low-orbit satellite communications will be in demand both in the passenger and cargo transportation throughout Russia, including for the operation of unmanned vehicles,” Evgeny Charkin, director of information technologies at Russian Railways, told the outlet. The company is planning to begin testing the approach as soon as next year, he added.

]]> READ MORE: BRICS should create their own internet – MP ]]>At the same time, Maksut Shadaev, the head of Russia’s Ministry of Digital Development, Communications and Mass Media, said Wi-Fi will be available on board Russian aircraft starting from 2028. Earlier this year, the minister announced that Russia is planning to launch 737 low-orbit satellites by 2030 to improve terrestrial internet speeds.

According to documentation obtained by the news outlet from the State Commission for Radio Frequencies, the authorities intend to allocate a number of frequency ranges to an “unspecified circle of people” for the development, production, and use of terminals of non-geostationary systems in Russia. Operation of the satellite equipment is not expected to require any permits.

]]>Read Full Article at RT.com]]>

The Dutch-registered parent company of Russia's largest search engine Yandex has announced it has finalized the sale of its Russian business. The deal will see Russia's largest technology player come entirely under domestic ownership.

The Netherlands-registered firm has sold a remaining 28% in the company’s Russian business for $2.8 billion and 162.5 million of its Class A shares, according to the statement.

Since 2022, Yandex NV has been seeking to divest its Russian business, which generates the lion’s share of its revenue, and to spin off a number of its international startups.

Earlier this year, the tech giant agreed to sell its Russian operations to a consortium of local investors and to spin off its main international projects in a cash-and-shares deal worth $5.2 billion.

The first stage of the transaction was completed in May when Yandex NV sold 68% of the shares in IPJSC Yandex to private investors.

]]> Read more

The Dutch-based firm will reportedly be renamed Nebius Group after shareholder approval and will stop using Yandex brands by July 31.

The co-founder of the Russian tech giant, Arkady Volozh would return as Yandex NV CEO, Bloomberg reported on Monday, citing two people familiar with the matter who asked not to be identified before an official announcement.

Volozh, who has lived in Israel since 2015 and has not visited Russia since the Ukraine conflict, resigned as Yandex’s CEO after the EU imposed sanctions on him in 2022. In March, however, the bloc lifted the restrictions, following his criticism of Moscow’s actions.

The Dutch company is expected to launch a new international branch which would control licenses for developing technology for self-driving cars, cloud storage, data labeling and ed-tech projects.

]]>Read Full Article at RT.com]]>

Many of France’s most wealthy residents may consider leaving the country over concern about political instability and the prospect of higher taxes in light of the recent parliamentary election, Bloomberg reported on Friday, citing wealth managers. The recent vote left no party with an absolute majority, resulting in a hung parliament, but a left-wing alliance took the most seats.

Several wealth advisers said many of their panicking clients had already begun transferring capital abroad and started to look into possible expatriation. Most are worried that, while neither the far-right nor far-left won the election outright, some of the parties’ campaign proposals, such as higher taxes, could soon become law.

“We have new clients like top executives who are asking what they can do to shield themselves. Following Brexit there was an influx of bankers into France, but these high-earners will leave because they won’t want to pay more taxes,” Xenia Legendre, a Paris-based managing partner at Hogan Lovells law firm, told the news outlet.

The left-wing New Popular Front (NFP), which won the most seats in the election, promised to tax the super profits of companies and reinstate a wealth tax on the rich. Such legislation would run counter to the policies put in place by President Emmanuel Macron, which are considered more friendly to the wealthy and even earned him the nickname “president of the rich.”

]]> Read more

According to Julien Magitteri, a private wealth adviser at Barnes Family Office by Côme, some people started moving capital out of France even before the second round of voting, largely to countries such as Switzerland and Luxembourg. Most wealth managers say that places such as Italy, Dubai, Singapore, and the US are also among the destinations being considered by many of France’s top earners.

France is home to some of the world’s richest people, including Bernard Arnault, Europe’s richest man and head of the luxury goods company LVMH; Francoise Bettencourt Meyers of the beauty empire L’Oréal, considered the richest woman in the world; and the Wertheimer brothers, who control the Parisian fashion house Chanel.

According to a poll conducted by the agency Elabe earlier this week, seven out of ten French are dissatisfied with the results of the elections and the composition of the new National Assembly, saying that the country is now “ungovernable.”

For more stories on economy & finance visit RT's business section

]]>Read Full Article at RT.com]]>

The Russian authorities have no plans to restrict access to YouTube, Kremlin spokesman Dmitry Peskov stated on Friday, responding to rumors that the popular video-hosting service could soon be banned in the country.

Earlier in the day, Russia’s largest internet provider, Rostelecom, warned that users in Russia could soon experience noticeable slowdowns on YouTube due to technical issues related to parent company Google’s servers in the country. Rostelecom explained that this hardware has not been updated in over two years after the US-based tech giant limited its presence in Russia following the outbreak of the Ukraine conflict.

Soon thereafter, several Russian media outlets reported, citing anonymous sources supposedly close to the Kremlin, that YouTube would be completely blocked in the country by September.

Speaking to reporters, Peskov stressed that the government has no plans to block the online video-sharing service and that the slowdown is being caused by technical issues related to Google’s servers.

Asked by reporters if Moscow had considered contacting YouTube to remedy the issue, Peskov stated that Russian companies had probably already tried to reach out to the service.

]]> Read more

The deputy head of the State Duma Committee on Information Policy, Anton Gorelkin, also stated in a post on Telegram that issues with the speed of service of YouTube in Russia are not occurring due to any decision made by the country’s regulator.

In 2022, several months after the outbreak of the Ukraine conflict, Google notified Russian internet service providers that it would terminate its contracts for servicing Google Global Cache servers located in the country.

The servers are used to speed up the loading of Google pages, including YouTube content, and reduce the amount of cross-border traffic by temporarily storing uploaded data, thus reducing the cost of network infrastructure.

]]>Read Full Article at RT.com]]>

Russia has temporarily nationalized the assets of metal packaging manufacturer Silgan Holdings Austria. According to a decree signed by Russian President Vladimir Putin on Thursday, the Russian assets of the company have been transferred under state supervision.

All of the shares in two plants owned by the Austrian arm of the US company – Silgan Metal Packaging Stupino in Moscow Region, and Silgan Metal Packaging NM in Adygea – have been handed over to the Russian Federal Property Management Agency following the presidential decree.

Silgan Holdings is a Connecticut-based manufacturing company which produces consumer goods packaging and has more than 100 manufacturing facilities operating in North and South America, Europe, and Asia. The company’s annual net sales were estimated at about $6 billion in 2023.

In Russia, business activity at both plants has seen a steep decline over the past two years. In 2022, overall revenue slid to 3.6 billion rubles ($41 million) from 4.3 billion rubles ($49 million) in 2021. Last year, Silgan’s Russia-based plants with a total capacity of 350 million containers annually were essentially idle, according to financial records. The overall income totaled 15 million rubles ($171,000), while its net loss reached 312 million rubles ($3.5 million).

]]> Read more

Last April, the Russian president signed a decree allowing for the temporary takeover of foreign assets deemed critical for the country’s security and national interests. The transfer of Silgan’s assets under the trusteeship means that the state agency will act as a shareholder and make management decisions.

Dozens of foreign companies have left the Russian market as a result of sanctions pressure since the start of the Ukraine conflict in February 2022. Like the sanctions themselves, the companies’ departure was intended to weaken the Russian economy.

However, the situation has played into the hands of Russian businessmen, especially due to divestment rules the government introduced last year. Firms exiting Russia are required to sell their assets at a 50% discount, while also needing to obtain government permission for the sale, and are required to pay a mandatory fee to the Russian budget.

]]>Read Full Article at RT.com]]>

US consumer electronics giant Apple on Wednesday retained the position as the world’s most valuable company, with a market capitalization of over $3.5 trillion, according to Nasdaq data.

As of 18:30 GMT, the iPhone maker’s stock was trading up 1.4% at nearly $232 per share, bringing its market cap to $3.543 trillion, the highest any publicly traded company has ever achieved. The previous record belonged to rival tech giant Microsoft, whose highest closing market cap was $3.475 trillion on July 5.

This is not the first record-breaking valuation for Apple. In August 2018, it became the first company to reach a market cap of $1 trillion; two years later, it was the first to reach $2 trillion and then last June it hit $3 trillion.

]]> READ MORE: Apple no longer world's most valuable company ]]> Apple stock had a rough start to this year amid concerns over weakness in iPhone sales and competition from other tech majors, which triggered a number of analyst downgrades. The company lost its position as the world’s most valuable company to Microsoft in January, following the latter’s aggressive rollout of a number of AI features over the previous year. The two have been neck and neck in terms of market cap over the last month, with Apple briefly catching up in early June, before again falling behind Microsoft. ]]> Read more

Commenting on Apple’s performance, Wedbush Securities senior analyst Dan Ives told CNBC that the company’s introduction of AI features could take its valuation to $4 trillion next year.

“I think the stocks are telling you what you already know. For Apple right now, they’re at the top of the mountain… With Apple Intelligence, they have the keys to the castle. This is the start of a Renaissance of growth… a year from now I think we can look forward to a $4 trillion market cap,” Ives predicted, noting, however, that Apple will likely spend it racing to hit this mark with Nvidia and Microsoft.

For more stories on economy & finance visit RT's business section

]]>Read Full Article at RT.com]]>

Dozens of oil tankers that previously shipped Russian crude currently remain empty and idle off the Russian, Chinese, and Turkish coasts after being hit by Western sanctions, Bloomberg reported on Wednesday, citing tracking data.

Some of the 53 vessels were reportedly targeted for breaching a G7 price ceiling on Russian oil exports, while others were designated for belonging to Russian state tanker enterprise Sovcomflot. Some were sanctioned over alleged environmental risks.

In February, the US targeted Sovcomflot and more than a dozen vessels affiliated with the state-owned firm.

According to data quoted by the news outlet, nearly all of the oil carriers that have been designated for breaching US, UK, and EU sanctions since October have been unable to take on any cargoes since. Only three of them were reportedly loaded, and subsequently turned off their transponders to hide further activities.

Bloomberg noted that freight rates, which are dropping partially due to sanctions, prove that the penalties have disrupted the movement of vessels but have failed to visibly raise Russia’s costs for individual cargoes.

]]> READ MORE: Russian oil revenues continue to grow – Bloomberg ]]> Western governments introduced the price cap along with an embargo on Russian seaborne oil in an attempt to hit the country’s economy, while at the same time keeping Russian crude flowing to global markets so as not to trigger price hikes. The measures were imposed in December 2022, and were followed in February 2023 by similar restrictions on exports of Russian petroleum products.Moscow responded by rerouting most of its energy exports to Asia, particularly India and China, where Russian crude can be sold above the West’s price cap as New Delhi and Beijing have opted not to join sanctions against one of the world’s biggest oil producers.

]]>Read Full Article at RT.com]]>

The Group of Seven “likely” abandoned the US plan to expropriate Russia’s frozen central bank assets due to a “veiled threat” from Saudi Arabia, Bloomberg has reported.

The US and UK had been pushing for outright seizure of around $280 billion in Russian sovereign funds, which the West had frozen in 2022 citing the Ukraine conflict. The EU, where most of the immobilized assets are held, was reluctant to see the euro endangered by the possible backlash.

Saudi Arabia “privately hinted” that it might sell some of its EU debt holdings if the G7 went ahead with the confiscation plans, Bloomberg reported on Tuesday citing “people familiar with the matter.”

One of the outlet’s anonymous sources described the Saudi Finance Ministry’s message as “a veiled threat,” while two others said Riyadh specifically mentioned French treasury debt.

This “likely influenced” the G7 to stop short of seizing the frozen Russian funds and opt to turn the interest they generated into loans to Kiev. Moscow has condemned the move as illegal, with former President Dmitry Medvedev suggesting it could be interpreted as a cause for war.

]]> Read more

“Our relation with the G7 and others is of mutual respect and we continue to discuss all issues that promote global growth and enhance the resilience of the international financial system,” the ministry said.

One Saudi official told the outlet that making such threats wasn’t his government’s “style” and that the ministry might have merely outlined the “eventual consequences” of seizures to the G7.

Saudi Arabia owns about $135 billion of US Treasuries and an unspecified amount of euro bonds. EU officials were less concerned about the impact on French debt than about other countries following Riyadh’s lead, Bloomberg’s sources said.

Two of the sources questioned the credibility of Saudi Arabia’s alleged threat, noting that there wasn’t a run on G7 currencies when the Russian funds were first frozen. The same argument was brought up by Daleep Singh, the White House’s deputy national security adviser, at a conference in May.

The February 2022 freezing of Russian sovereign assets was a move without precedent. A number of experts in the West have cautioned against attempting to confiscate the funds, noting that this could undermine the dollar, the euro, and the entire global financial system.

]]>Read Full Article at RT.com]]>

Mutual trade between Russia and the members of the Shanghai Cooperation Organization (SCO) surged by 25% in 2023, amounting to $333 billion, according to Russian Industry and Trade Minister Anton Alikhanov, as quoted by TASS.

Speaking on Tuesday at the international industrial exhibition Innoprom in the Russian city of Ekaterinburg, Alikhanov said Russia’s direct investment in SCO countries had reached $10.2 billion. He added that “nearly the same amount came into Russia.”

“In economic terms, our country is one of the most active participants in the organization,” Alikhanov said.

Founded in 2001, the SCO comprises China, India, Iran, Kazakhstan, Russia, Kyrgyzstan, Pakistan, Tajikistan, Uzbekistan, and its most recent member Belarus. Several other countries participate in the role of observers. Currently, 14 countries, including Egypt as the only African state, hold SCO dialogue-partner status, which allows them to take part in the organization’s specialized events at the invitation of members.

The goals of the organization are to strengthen relations between member states and promote cooperation in the political, economic, scientific, cultural, and educational fields.

]]> READ MORE: European country joins SCO ]]> Last week, speaking at the SCO summit in the Kazakh capital of Astana, Russian President Vladimir Putin said the use of national currencies in Russia’s settlements with fellow SCO members had exceeded 92%.He reiterated Moscow’s proposal to develop an independent mechanism for settling payments within the SCO, adding that joint efforts made by finance ministers and central bank governors had helped to strengthen trade and investment ties within the group.

]]>Read Full Article at RT.com]]>

Over 2,500 Boeing 737 airplanes must be inspected due to a potential issue with emergency oxygen generators, the US Federal Aviation Administration (FAA) said on Monday.

In case of cabin depressurization, oxygen masks drop from the overhead compartments. After Boeing detected that some of the generators might not work due to a flaw with retention straps, the FAA issued an Airworthiness Directive requiring their immediate inspection.

The order affects some 2,600 Boeing 737 Max and Next Generation models. Airlines have between 120 and 150 days to finish inspections and undertake “corrective actions” if needed, and have been banned from installing potentially defective parts.

On June 17, Boeing sent a memo to airline clients identifying a potential problem with the emergency oxygen supply. Under certain circumstances, the plane maker said, the restraining straps on the generators could shift by up to 1.9 centimeters, preventing them from working properly. The company blamed a faulty adhesive, which was introduced in 2019.

“We have gone back to the original adhesive for all new deliveries to ensure the generators remain firmly in place,” Boeing said in a statement. Inspections of undelivered airplanes have not identified any units that were affected by the flaw, the company added.

]]> Read more

Monday’s announcement comes less than a day after Boeing was fined $243.6 million for not complying with the terms of its 2021 settlement with the US government. Following a series of fatal crashes of the 737 Max – which resulted in the grounding of the entire fleet in 2019-2020 – Boeing had agreed to pay over $2.5 billion to avoid prosecution for deceiving the FAA about the autopilot flaws.

Boeing is the last remaining maker of large commercial aircraft in the US. Under Sunday’s plea deal, the manufacturer has agreed to invest at least $455 million over the next three years to improve its safety and compliance programs and submit to a three-year probation by a special monitor appointed by the government.

]]>Read Full Article at RT.com]]>

Beijing has announced the next stage in its investigation into EU brandy imports, in the latest tit-for-tat measure after the bloc imposed provisional duties on Chinese electric vehicles (EVs).

The EU on Thursday slapped tariffs ranging from 17.4% to 37.6% on Chinese EV imports on top of existing 10% duties, citing Beijing’s “unfair subsidization” of car manufacturers.

The Chinese Ministry of Commerce responded on Friday by announcing that it will hold a hearing on July 18 to address claims that EU brandy producers are selling their goods in China below market rates.

The hearing requested by brandy houses Martell, Societe Jas Hennessy & Co., Remy Martin, and others will assess “industrial damage, cause and effect, and public interest in the anti-dumping probe of related brandy products,” according to the ministry’s statement.

The Chinese probe will look into EU-produced brandy in containers holding less than 200 liters imported between October 2022 and September 2023, the ministry added. It will also investigate the alleged damage inflicted on the Chinese brandy industry between January 2019 and September 2023.

]]> Read more

Meanwhile, EU countries are split on the move, with Germany, whose automakers made a third of their sales in China last year, fearing the curbs will do more harm than good.

German car giant Volkswagen reportedly called the move “detrimental,” while the head of BMW said the tariff battle “leads to a dead end”.

The value of EU imports of Chinese EVs surged to $11.5 billion in 2023, from just $1.6 billion in 2020, accounting for 37% of all EV imports to the bloc, according to recent research.

Last year, the European Commission launched an investigation into claims that subsidies allowed Chinese EVs to be sold at much lower prices than ones produced in the bloc.

China has repeatedly urged the EU to cancel its EV tariffs, warning that it would “not sit back and watch” and expressed a willingness to negotiate. In January, Beijing launched a first reciprocal anti-dumping investigation into EU brandy imports and in June started a second probe into pork shipments from the bloc.

]]>Read Full Article at RT.com]]>

US sanctions policies will eventually result in the dollar losing its longstanding dominance in the global economy, the founder of fertilizer producer EuroChem, Andrey Melnichenko, has told American journalist Tucker Carlson.

In a nearly two-hour interview published on Carlson’s YouTube channel on Wednesday, the two talked on a range of matters, including the Western sanctions imposed against the businessman over the Ukraine conflict.

Melnichenko, who founded EuroChem and coal-producing company SUEK two decades ago, was placed on the US and EU sanctions list in 2022, along with his wife. He was also blacklisted by other Western countries, including the UK and Switzerland.

Talking about the sanctions, Melnichenko said that he considers himself “collateral damage of the bigger conflict.”

The businessman also claimed that many so-called traditional institutions, including the world’s reserve currency, will cease to exist as a result of the Western sanctions.

The de-dollarization process is gaining momentum across the globe, according to Melnichenko, who pointed out that currently more than 50% of Chinese foreign trade is settled in currencies other than the greenback. Just over a decade ago, around 90% of the country’s cross-border trade was conducted in the US currency.

In Russia, the dollar used to be the dominant currency for exports and imports, Melnichenko said, adding that “today it’s 14%, more or less like this, and the same process is going in other countries.”

“In general, I think that the dollar will lose its position as the dominant world currency,” the businessman predicted, adding that this would be “one of the major consequences [of the sanctions].”

According to Melnichenko, a new multipolar world order is currently in the making as “we are going through a period of time when the dominance of one superpower, the United States, will no longer be in the future in the same way it was before.”

He further noted that China is growing with an “incredible speed” to become a world superpower. “We will see at least two superpowers, which will in one way or another organize world affairs going forward,” Melnichenko concluded.

]]>Read Full Article at RT.com]]>

Elon Musk’s net worth has decreased by almost $30 billion, more than any other billionaire in the world this year, according to Forbes magazine rankings published on Thursday.

Although the Tesla and SpaceX founder remains the richest person on earth, his personal fortune declined from $251.3 billion at the beginning of the year to $221.4 billion as of June 28, the final day of stock market trading in the second quarter of 2024.

Forbes described this as “a rare loss in what was otherwise a great stretch for the megarich as the stock market boomed” and the net worth of the world’s ten wealthiest people grew to $1.66 trillion.

Musk’s setback came down to a Delaware judge’s verdict from January, invalidating his Tesla compensation package on behalf of an activist investor. The bonus was valued at $51 billion at the time. Forbes has discounted the value of those stock options by 50% even if Musk somehow manages to get them, citing likely litigation.

]]> Read more

Musk still has a $14.4 billion stake in the generative artificial intelligence startup xAI, a $7 billion stake in X (formerly Twitter), which he acquired in 2022, and an estimated $75 billion stake in his private aerospace company SpaceX, among other enterprises.

According to Forbes, Musk has lost an estimated $99 billion since November 2021, when his portfolio was worth about $320 billion.

In March, Musk was briefly dethroned as the world’s richest man by Amazon founder Jeff Bezos, who has since slipped back to the number-two spot at just over $214 billion. Bringing up the top three is Bernard Arnault, Europe’s richest man and head of the luxury goods company LVMH, now valued under $197 billion.

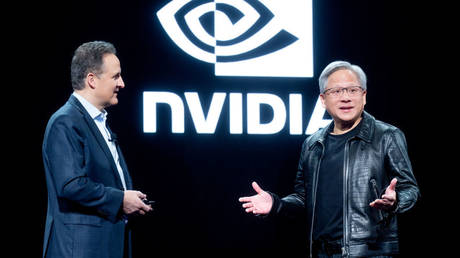

Much of 2024’s billionaire bonanza has been the result of an artificial intelligence boom. The biggest winner has been NVIDIA chief executive Jensen Huang, who gained $64.1 billion this year and moved up from 27th place to 14th in the Forbes rankings.

The stock market has also been kind to Meta CEO Mark Zuckerberg (up $61.5 billion), Dell CEO Michael Dell ($35.8 billion), Oracle chairman Larry Ellison ($37.7 billion richer), and Google co-founder Larry Page (up $33.1 billion).

Other big ‘losers’ were Mexican telecom mogul Carlos Slim Helu (down $13.9 billion), Nike co-founder Phil Knight (down $9.2 billion), and Bezos’ ex-wife Mackenzie Scott, who spent $4.7 billion mainly on liberal political causes.

]]>Read Full Article at RT.com]]>

The European Union has imposed steep new tariffs on electric vehicles imported from China following an anti-subsidy probe. Brussels is seeking to stem a flood of low-priced EVs from the Asian economic superpower to protect its own manufacturers.

The provisional extra duties of up to 38% will apply from July 5 for a maximum duration of four months, according to a press release issued by the European Commission on Thursday.

Car maker BYD will be subject to a 17.4% tariff, while Geely, which owns Sweden’s Volvo, is facing a 19.9% tariff. Other car makers that cooperated with the investigation will face an average duty of 20.8%. The duty for other non-cooperating companies will be 37.6%, the release states.

The measures are in addition to the current 10% tariff levied on all electric cars imported from China.

]]> Read more

A definitive decision on the tariffs is due by November, while talks will continue between Brussels and Beijing in a bid to resolve the issue.

When the plans for new EV duties were announced last month, China’s commerce ministry warned that the EU could trigger a “trade war” if it continues to escalate tensions. Beijing also accused the bloc of unfair practices during its anti-subsidy probe, and responded by launching an anti-dumping investigation in relation to certain pork products from the EU.

The EU is the largest overseas market for Chinese EV makers. While Chinese imports into Europe have largely been dominated by Tesla, Dacia and BMW cars produced there, Brussels-based green group Transport and Environment (T&E) has projected that Chinese brands could reach 11% of the European EV market in 2024, and 20% in 2027.

]]> READ MORE: Musk blasts US tariffs on China ]]> Chinese automakers have actively penetrated foreign markets in recent years and are steadily closing the gap with Western rivals, particularly in terms of electric cars.The EU’s move comes after the US raised its tariff on Chinese EVs from 25% to 100% in May.

For more stories on economy & finance visit RT's business section

]]>Read Full Article at RT.com]]>

Members of the Shanghai Cooperation Organization (SCO) are ramping up settlements in national currencies, Russian President Vladimir Putin stated on Thursday at the SCO summit in Astana, Kazakhstan.

Founded in 2001, the SCO is an economic and security bloc covering most of Eurasia and accounting for more than 20% of global GDP. The organization includes India, Iran, Kazakhstan, China, Kyrgyzstan, Russia, Pakistan, Tajikistan, Uzbekistan, and now Belarus.

Currently, 14 countries, including Egypt as the only African state, hold SCO dialogue-partner status, allowing them to participate in the organization’s specialized events at the invitation of its members.

Speaking at a Council of Heads of State meeting, Putin noted that the SCO members have increased the use of national currencies in mutual settlements.

]]> Read more

The global trend toward using national currencies in trade instead of the US dollar gained significant momentum after Russia was cut off from the Western financial system and had its foreign reserves frozen in 2022.

Putin also reiterated Russia’s proposal to create an independent mechanism for settling payments within the SCO, adding that meetings between finance ministers and central bank governors help boost trade and investment ties within the organization.

Earlier this year, the head of the Russian central bank, Elvira Nabiullina, noted that more countries were having doubts about the West’s SWIFT, after many Russian banks were cut off from the Belgium-based financial messaging system following the start of the Ukraine conflict in 2022.

]]>Read Full Article at RT.com]]>

Russia’s revenues from oil exports surged by almost 50% last month compared to a year ago as prices for the country’s flagship Urals grade soared and producers adapted to Western sanctions, Bloomberg reported on Wednesday.

Moscow’s income from crude sales rose with oil-related taxes climbing to 590.6 billion rubles ($6.7 billion) last month compared to 402.8 billion rubles ($4.5 billion) in June 2023, according to Bloomberg calculations based on Russian Finance Ministry data.

Total oil and gas profits grew by 41% to 746.6 billion rubles ($8.4 billion), the data showed.

According to the outlet, the surge has been attributed to higher prices for Russia’s key export Urals blend. The ministry calculated June taxes based on the Urals price of $67.37 a barrel, up from $53.50 a year ago.

Urals’ discount to the global Brent benchmark has declined, despite the $60 per barrel price cap on Russian oil introduced by the G7 and EU.

Western governments imposed the price cap along with an embargo on Russian seaborne oil in an effort to hit the country’s economy, while at the same time keeping Russian crude flowing to global markets. The sanctions were imposed in December 2022 and were followed in February 2023 by similar restrictions on exports of Russian petroleum products.

]]> Read more

EU officials have repeatedly acknowledged that Moscow has been successfully sidestepping the cap, as “almost none” of the crude shipments have been sold at or below the price limit, dealing a blow to Western efforts to curtail Russia’s energy revenues.

Last month, finance ministry data showed that Russian budget revenues from oil and gas had soared by 73.5% between January and May this year, compared to the first five months of 2023. Proceeds from oil and gas sales hit 4.95 trillion rubles ($55.7 billion) in the first five months of the year.

Russia expects oil and gas earnings to reach 10.99 trillion rubles ($125 billion) this year, according to finance ministry data.

]]>Read Full Article at RT.com]]>

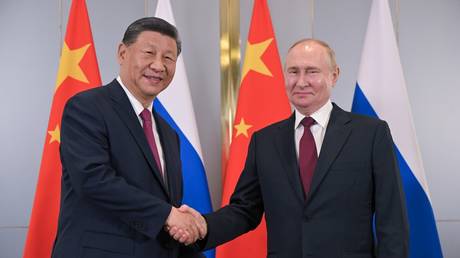

Turkish President Recep Tayyip Erdogan said on Wednesday that Ankara and Moscow would continue strengthening economic ties with the aim of increasing their annual trade turnover to $100 billion.

He made the remarks during his meeting with Russian President Vladimir Putin at the Shanghai Cooperation Organization (SCO) summit in the Kazakh capital Astana.

“Currently the volume [of trade] is $55 billion,” Erdogan stated, adding that the two sides believe they can achieve their goal of doubling that figure.

Putin declared that relations between the two countries had been developing consistently despite the complicated global situation. Moscow and Ankara are pursuing major joint projects as planned, he said, adding that “there’ve been no hitches.”

In 2023, the two leaders agreed to encourage mutual investment and help Russian and Turkish businesses to enter each other’s markets. It’s also been agreed to introduce the Russian ruble as a settlement currency in bilateral trade, including payments for Russian natural gas supplies.

]]> Read more

US officials have repeatedly identified Türkiye as a potential hub for sanctions evasion, with some Western officials raising concerns about allegations of trade between Turkish firms and sanctioned Russian entities.

Moscow and Ankara are currently working on several initiatives related to natural gas exports, and plan to continue to build relations in the energy sector.

]]>Read Full Article at RT.com]]>

Russian natural gas exports to Western, Central, Southern, and Southeastern Europe surged by 23% year-on-year in June, rebounding from last year’s decline, according to estimates from Reuters.

Energy giant Gazprom ramped up pipeline gas supplies, which totaled 81.8 million cubic meters (mcm) per day last month, up from 66.8 mcm in June last year, the outlet reported, citing data from the European gas transmission group Entsog and Gazprom’s reports on gas transit via Ukraine.

The Russian energy giant’s June exports declined from the 89.5 mcm daily volume in May due to planned maintenance at the undersea TurkStream pipeline, but were up from the 66.8 mcm recorded in June 2023, the outlet said.

So far this year, Russian gas exports to the region have totaled about 15.5 billion cubic meters (bcm).

Before the start of the Ukraine conflict Russia delivered around 155 bcm of natural gas to the European Union, primarily via pipelines. Gazprom, once the EU’s main gas supplier, reduced its exports to the bloc dramatically in 2022, following Western sanctions and the sabotage of the Nord Stream pipelines.

]]> Read more

In response to Western sanctions, Russia has rerouted gas deliveries eastwards and sharply boosted sales to China. Last year, Beijing increased pipeline gas imports from Russia via the Power of Siberia pipeline to 22.7 bcm, nearly 1.5 times more compared to the 15.4 bcm shipped in 2022, data shows.

Nonetheless, Gazprom continues to supply gas for transit to Western and Central Europe through Ukrainian territory via the Sudzha gas pumping station.

The EU reduced its reliance on Russian energy by replacing it with imports of LNG from countries including the US, which became the main source of gas for the bloc. However, Western nations have not stopped buying Russian energy despite the unprecedented sanctions they have imposed against Moscow. These nations have just switched to “workarounds” to procure Russian imports, according to the Russian Energy Ministry.

In its latest round of sanctions, the EU has banned operations for re-exporting Russian LNG via the bloc. Deliveries of LNG for use within the EU remain unaffected, however.

]]>Read Full Article at RT.com]]>

Pop superstar Taylor Swift’s European tour is not the only factor keeping inflation high across the euro area, European Central Bank (ECB) President Christine Lagarde has said, according to a CNBC report on Tuesday.

The singer’s 18-city sell-out European Eras Tour kicked off in May, with some experts noting a significant economic impact on cities across the 20-nation Eurozone.

“It’s not just Taylor Swift, you know,” Lagarde told CNBC, responding to a question about whether Swift’s tour boosted services inflation across the euro area.

Services inflation, one of the ECB’s closely watched measures, held steady in the Eurozone, at 4.1% in June. Core inflation, excluding energy, food, alcohol and tobacco, remained at 2.9% from the prior month, narrowly missing the 2.8% consensus forecast.

At the same time, headline inflation fell to 2.5% in June, down from 2.6% a month before, in line with expectations from a Reuters poll of economists.

“Services is the difficult one,” Lagarde said, adding that “the jury is still out” on whether that stickiness is permanent.

]]> Read more

There’s been much debate lately about the economic impact of Swift’s tour on the global economy as consumers traditionally splurge on concerts, meals, vacations and other recreational activities, pushing up prices. The impact was even dubbed by some as ‘Swiftflation’ and ‘Swiftonomics.’

Compared to her 2023 tour of the US, Swift’s European leg will bring an “even greater economic impact” this summer, Natalia Lechmanova, chief economist at the Mastercard Economics Institute, told Forbes earlier this year.

Experts cited by CNBC pointed out that overall increased consumer spending around major music tours, including for artists such as Bruce Springsteen, Pink and Sting, has been providing an economic boost. Others claimed that it is hard to gauge, insisting that central bankers should pay less attention to the impact of these one-off events.

]]>Read Full Article at RT.com]]>

The price of Bitcoin could be affected by the upcoming repayments to thousands of victims in the 2014 heist on the now defunct Mt. Gox virtual currency exchange, experts cited by CNBC believe.

Bitcoin, the world’s largest cryptocurrency, tumbled below $60,000 last week, marking its second-worst weekly decline of the year.

On Monday, the bankrupt Mt. Gox exchange, which is based in Tokyo, announced that it will start distributing the stolen assets in the first week of July. It is expected to return more than 140,000 Bitcoin worth almost $9 billion.

According to the court-appointed trustee overseeing the exchange’s bankruptcy proceedings, disbursements to the firm’s roughly 20,000 creditors will be in a mix of bitcoin and bitcoin cash.

Trustees put together a repayment plan and received a deadline of October 2024 from a Tokyo court last year.

Once the world’s top crypto exchange, handling over 70% of all Bitcoin transactions in its early years, Mt. Gox shut down and went bankrupt in February 2014 after suffering the biggest cryptocurrency heist on record. Hundreds of thousands of bitcoins were stolen from the exchange, which blamed hackers who took advantage of a software security flaw.

]]> Read more

“Many will clearly cash out and enjoy the fact that having their assets stuck in the Mt. Gox bankruptcy was the best investment they ever made,” John Glover, chief investment officer of crypto lending firm Ledn, said. “Some will clearly choose to take the money and run,” he said.

However, some experts believe that there is enough market liquidity to cushion the blow of any possible mass selling. The losses are likely to be contained and short-lived, analysts told the outlet.

“I think that sell-off concerns relating to Mt. Gox will likely be short term,” Lennix Lai, the chief commercial officer of crypto exchange OKX, told CNBC, noting that “many of Mt. Gox’s early users as well as creditors are long-term Bitcoin enthusiasts who are less likely to sell all of their Bitcoin immediately.”

Bitcoin enjoyed a major rally earlier this year, climbing over $70,000 after the US Securities and Exchange Commission’s approval of the first spot Bitcoin ETF. The latest Bitcoin halving – a mechanism to limit supply that takes place every four years – in April has also propelled the cryptocurrency’s price.

On Tuesday, Bitcoin was trading down almost 2% at $61,849 per token.

]]>Read Full Article at RT.com]]>

The Greek government has allowed more businesses to impose a six-day working week on their employees in a bid to bolster the country’s struggling economy. Greece is the first member of the European Union to introduce the measure.

Under the legislation, which entered into effect on July 1, the six-day scheme will be limited to private businesses providing services within 24 hours, as well as those experiencing an exceptional workload. Workers engaged in the food service and tourism sectors are exempt.

Under the extended workweeks, employees in certain industries and manufacturing facilities have the right to choose between working an additional two hours a day or an extra eight-hour shift. Employees will receive 40% extra pay for their sixth working day, or 115% more if they work on Sundays and holidays.

According to Prime Minister Kyriakos Mitsotakis, the measure is expected to help the government combat steadily declining productivity related to a shrinking population and a shortage of skilled workers.

]]> Read more